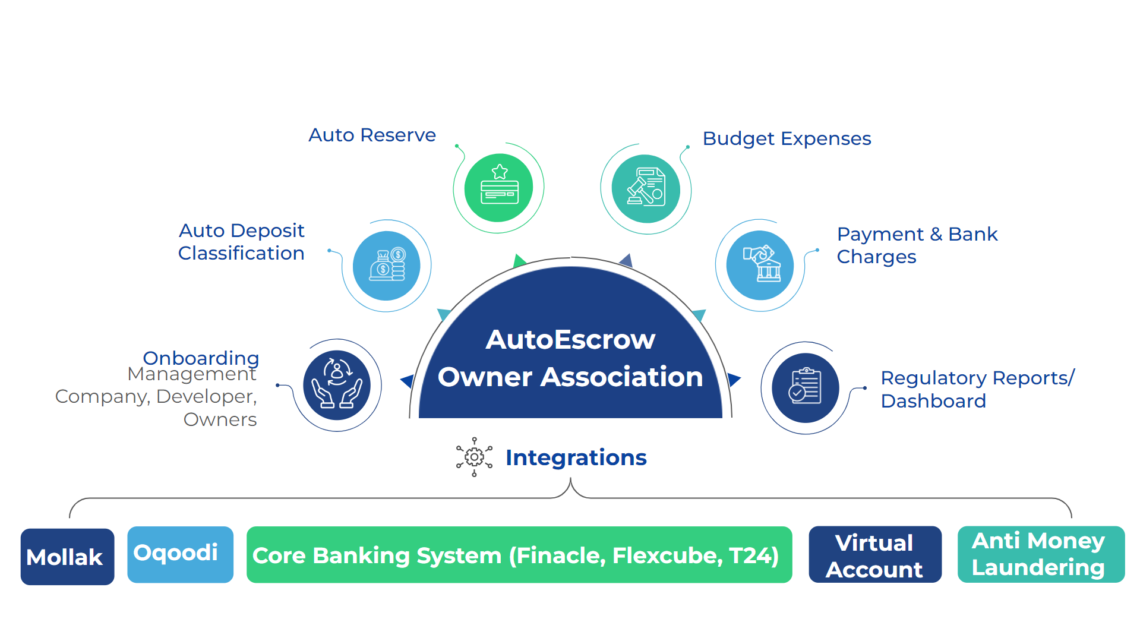

Efficient HOA Escrow Management: Simplify Finances with Autoescrow

Managing a Homeowner's Association (HOA) escrow account involves several key responsibilities. The HOA escrow account typically holds funds collected from homeowners to cover common expense...