-

Solutions

We would be delighted to learn more about your needs and explore potential ways in which we can assist you.

Let's TalkSolutions

Escrow Account Management

- Real Estate Escrow Management

- Commercial Escrow Management

- Owner Association Escrow Management

- Insurance Escrow Management

Financial Reconciliation Management

-

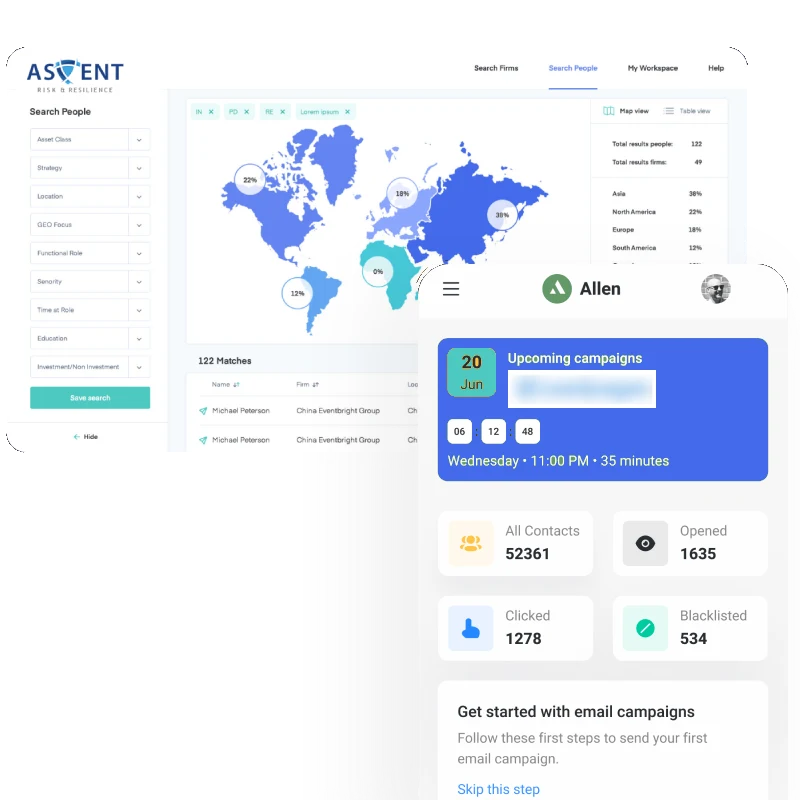

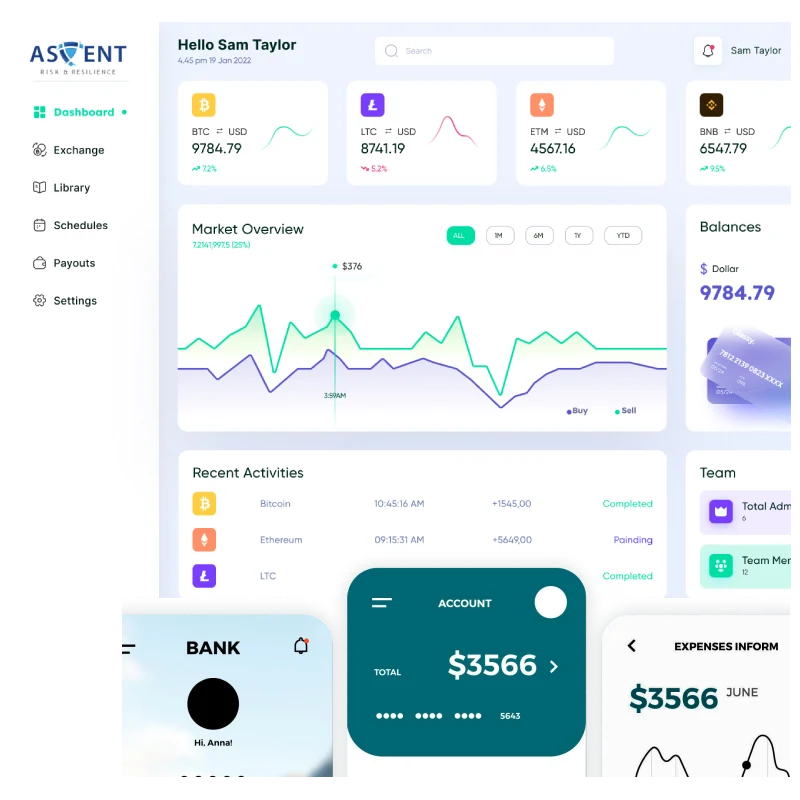

Products

You can experience the benefits of our product firsthand and discover how it can help your business succeed.

REQUEST A DEMO -

Customers

Ascent AutoEscrow Successfully Helped Leading Indian Bank Meet Its Ambitions.

READ MORE - Resources

BFSI Disrupted: The Importance of Operational Resilience For Financial Institutions.

READ MOREResources

Resources

-

About Us

We have a supportive and collaborative work environment where creativity and initiative are encouraged.

JOIN OUR TEAMAbout Us

- Request a Demo

Escrow & Trust Account Management Software Suite

An automated escrow ecosystem forreal estate, owner association, commercial escrow, and insurance escrow management.

Request a Demo