Escrow Made Easy: Autoescrow’s Effortless Escrow Account Management

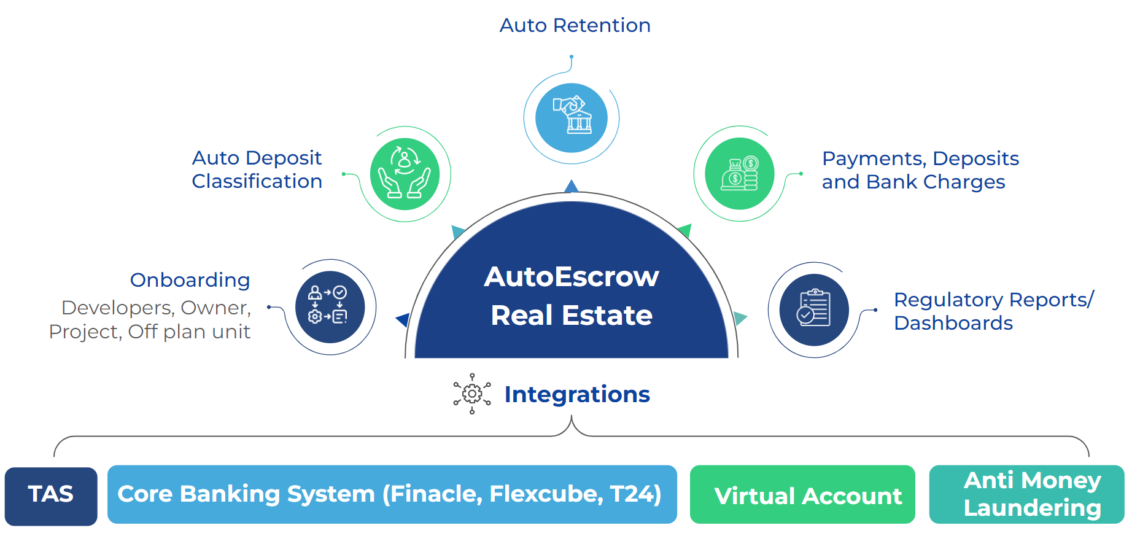

Escrow Made Easy: Autoescrow's Effortless Escrow Account Management Real estate escrow account management involves the administration and oversight of escrow accounts in real estat...