Is 2026 the Year of Regulatory Automation in Real Estate

The real estate industry is on the brink of a major transformation, one driven not by market cycles or investment trends, but by regulatory evolution and technological disruption. As govern...

The real estate industry is on the brink of a major transformation, one driven not by market cycles or investment trends, but by regulatory evolution and technological disruption. As govern...

The real estate industry is on the brink of a major transformation, one driven not by market cycles or investment trends, but by regulatory evolution and technological disruption. As governments tighten rules on data privacy, ownership transparency, AML (Anti-Money Laundering), RERA compliance, environmental sustainability, and digital transactions, traditional compliance models are struggling to keep up. Regulatory Automation in Real Estate is the necessity.

By 2026, real estate businesses developers, brokers, REITs, property managers, and housing finance companies will face unprecedented compliance complexity. Manual methods, fragmented systems, and reactive governance will no longer be sufficient. Artificial Intelligence (AI) and regulatory automation are emerging as the defining forces that will reshape how the industry manages compliance, risk, and operational assurance.

This is not just another wave of digital transformation. It is the compliance revolution, and 2026 will be the year real estate organizations either evolve or get left behind.

Real estate is one of the most regulated industries in the world. In India and globally, the regulatory burden continues to grow due to:

Real estate has long been a preferred route for money laundering due to:

Regulators are tightening due-diligence requirements across the value chain.

With DPDP (India), GDPR (Europe), CCPA (US), and global privacy legislation accelerating, real estate businesses must ensure:

Property buyers, tenants, and investors now demand digital trust.

Green building regulations, waste management mandates, and sustainability disclosures are becoming mandatory for large developers and corporations.

Online property listings, digital signatures, e-KYC, and fintech-driven home loans require higher standards of cyber and operational compliance.

RERA (India), HMDA, BDA, CREDAI, municipal norms, and land-record digitization efforts continue to increase reporting and documentation obligations.

The result: a compliance ecosystem that is becoming too complex, too dynamic, and too costly to manage manually.

2026 is shaping up to be the breakthrough year for regulatory automation in the real estate sector due to three converging forces:

Governments worldwide are preparing stricter mandates relating to:

2025–2026 will see many of these rules enforced.

Banks and institutional investors now require:

Failure to comply may result in loan delays, investment barriers, or project challenges.

The real estate sector, historically slow to adopt technology, is finally embracing:

By 2026, AI-driven compliance tools will move from “optional” to “operational necessity.”

AI-driven regulatory automation refers to the integration of advanced technologies—such as AI, ML, NLP, OCR, RPA, and predictive analytics—to automate compliance activities like:

It replaces manual, repetitive, and error-prone tasks with intelligent, self-learning workflows.

AI-driven compliance systems will fundamentally change how real estate organizations operate. Below are the most impactful transformations.

Real estate depends heavily on complex documents like sale deeds, property titles, encumbrance certificates, construction permits, land records, etc.

AI + OCR can automatically:

AI-powered systems can detect suspicious financial patterns such as:

Machine learning algorithms analyze real-time data to flag potential AML violations before they escalate.

RERA requires:

AI-driven tools can automatically:

Real estate contracts are long, complex, and prone to human interpretation errors. AI can:

AI can collect and analyze sustainability data such as:

It then automates ESG reporting for regulators and investors.

Using historical data, external intelligence, and real-time monitoring, AI can predict:

AI-driven KYC platforms authenticate:

At the same time, they ensure data privacy compliance with laws like DPDP, GDPR, and CCPA through:

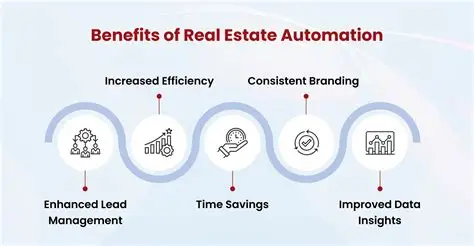

AI brings significant operational and strategic advantages:

Automation eliminates high manual effort and expensive consulting fees.

AI detects errors and anomalies that humans often miss.

Documentation, verification, and reporting become instant.

Proactive monitoring ensures timely compliance.

Helps build credibility and strengthen brand reputation.

Predictive analytics anticipate compliance breaches.

Multiple developments can be managed from a single platform. Real estate companies that embrace AI now will outperform competitors in speed, efficiency, governance, and profitability.

Although adoption is accelerating, real estate businesses must address:

Teams must adapt to AI-enabled workflows.

Many firms still rely on outdated, non-integrated tools.

Clean, structured data is essential for accurate predictions.

AI-powered systems require strong protection.

Automation adoption must be phased, not abrupt.

Despite these challenges, the long-term advantages outweigh short-term barriers.

To leverage AI effectively in 2026, organizations must:

KYC

Document verification

RERA reporting

Contract reviews

Define ownership

Ensure data consistency

Implement access controls

Ensure seamless workflow automation.

Adoption succeeds only when people embrace the technology.

Compliance accuracy

Time-to-compliance

Reduction in penalties

Audit readiness score

The compliance revolution in real estate is already underway and by 2026, AI-driven regulatory automation will become the industry standard. Real estate businesses that adopt advanced compliance technology will:

The message is clear: 2026 will not just be another year! It will be the year when real estate compliance is completely redefined by AI. Organizations that prepare today will lead tomorrow.